Research giving benchmark of most successful acquisition channels for retail

It's useful to know how your business compares to competitors in terms of the mix of online traffic. You can use the Google Analytics benchmarking feature for companies of a similar size and sector and that can be useful for arguing the case for reallocation of acquisition budgets, for example, more investment in organic or paid search.

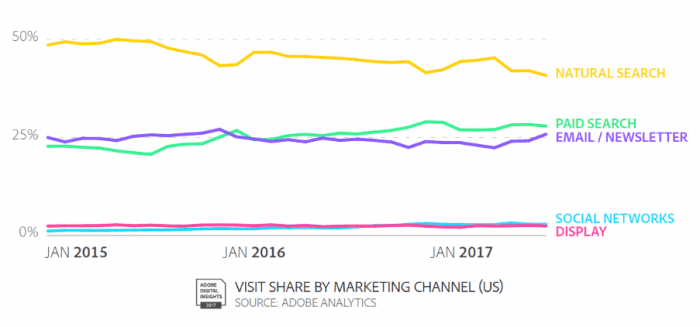

It's rare for data to be published which compares your digital media mix, i.e. the relative importance of different traffic sources driving visitors to websites. So, I thought it would be interesting to share this data from US Ecommerce sites.

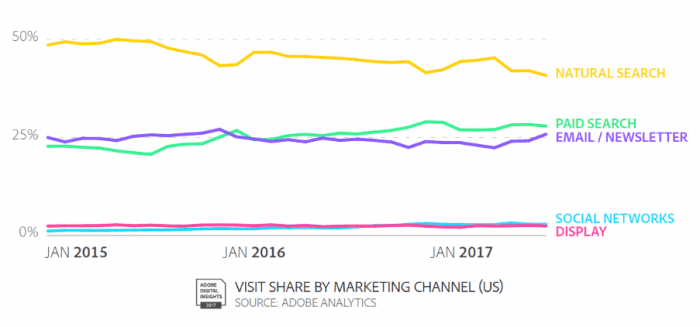

- Location: US Retail

- Date: Published Autumn 2017

- Sample: Top 250 US retailers (so representative of common consumer behaviour)

- Source: Adobe Retail Industry report

This retail visitor acquisition data shows that organic search is in the number one position, but declining in importance as Google has made changes on desktop and smartphone search to make organic less prominent. Paid search has increased as organic has declined. Email remains a strong performer. Due to their lower intent and clickthrough rates social media and display don't drive significant volumes for these larger businesses. Affiliate traffic isn't shown since it can't be tagged consistently across different companies.

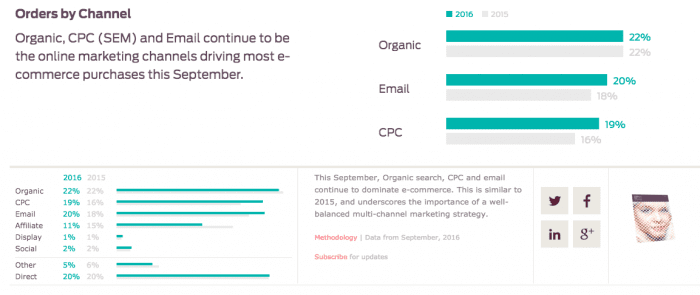

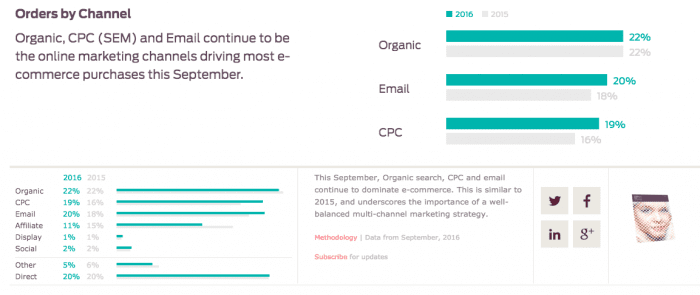

This Custora benchmark is no longer updated unfortunately, but we provide the latest data for comparison since it covers sales rather than site visits, this means that email is particularly high since its effective as a customer communications tool. Data is derived from over 100 million anonymized shoppers using Custora's predictive analytics platform which tracks $40Billion in e-commerce revenue, and 100+ online retailers. It gives data on device popularity, average order and most useful for benchmarking - the most effective acquisition channels indicated by channels driving orders on last click. Here is the latest channel breakdown from October 2016.

Reports can also be downloaded highlighting the latest trends. For example, the most recent notes that:

'Organic search still leads as the largest channel for online customer acquisition. But as more retailers move towards a 'free-to-paid' subscriber model and rely on third parties to help drive visitors to their sites, email and affiliate channels have seen an explosion in growth over the past few years.'

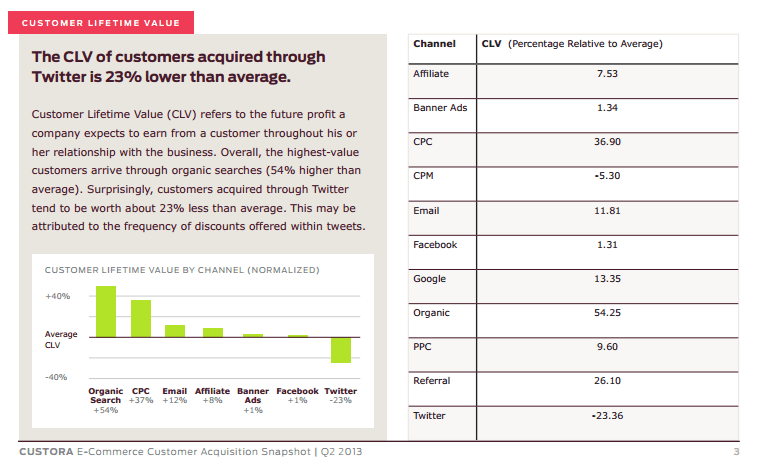

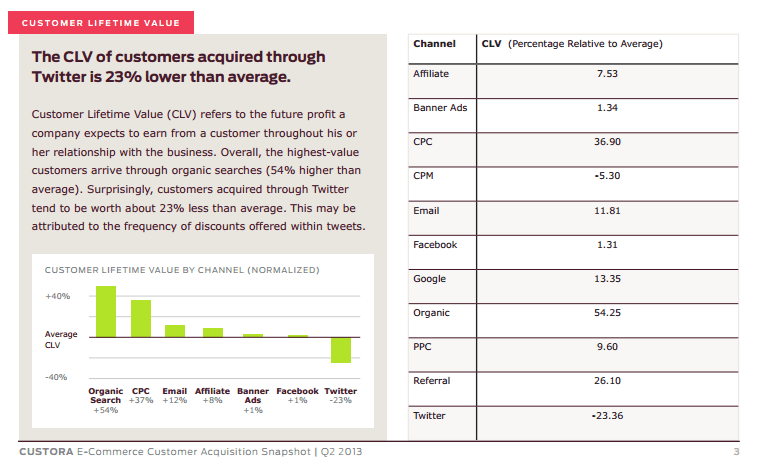

Customer lifetime value by channel

Here are some highlights around Customer Acquisition and Customer Lifetime Value.

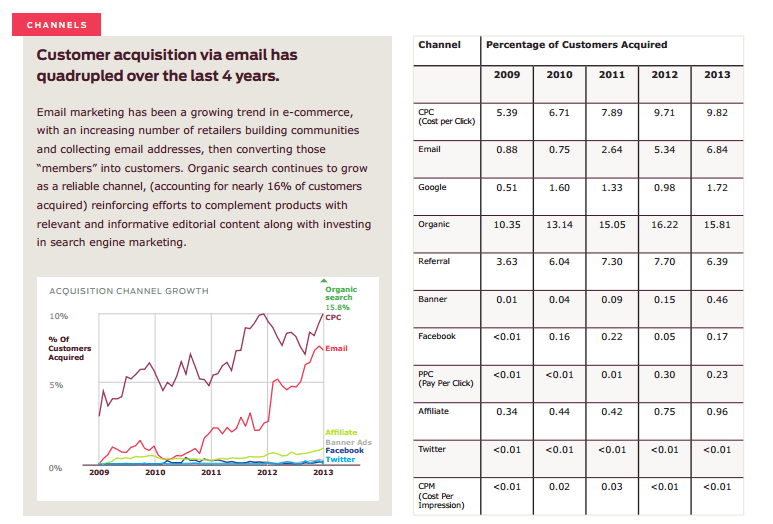

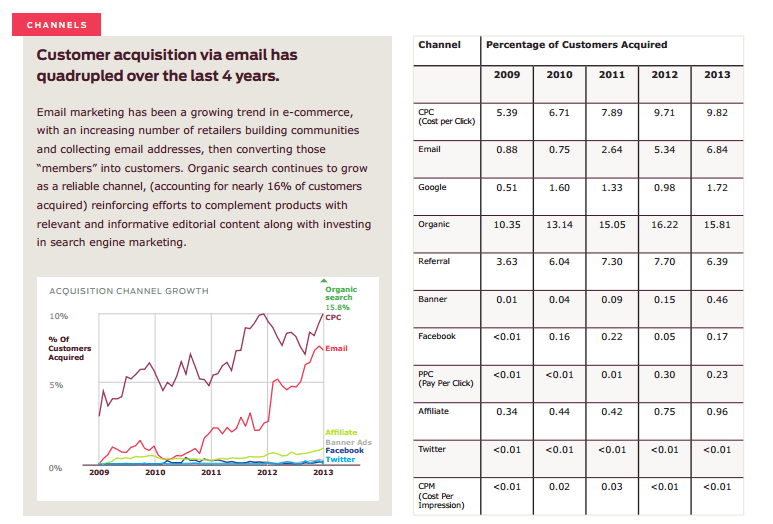

Customer acquisition via email has quadrupled over the last 4 years and the chart below shows the trends by different channels.

The Customer Lifetime Value Lifetime research shows the trends across channels. Social media often performs less well; CLV of those acquired through Twitter is 23% lower than average and Organic Search provides the highest valued customers - 54% higher than average.

Looking to create a Customer Acquisition Plan?

Our Online Customer Acquisition Planning guide steps you through how to create a budget and plan to meet your acquisition goals.

Access the Online customer acquisition guide